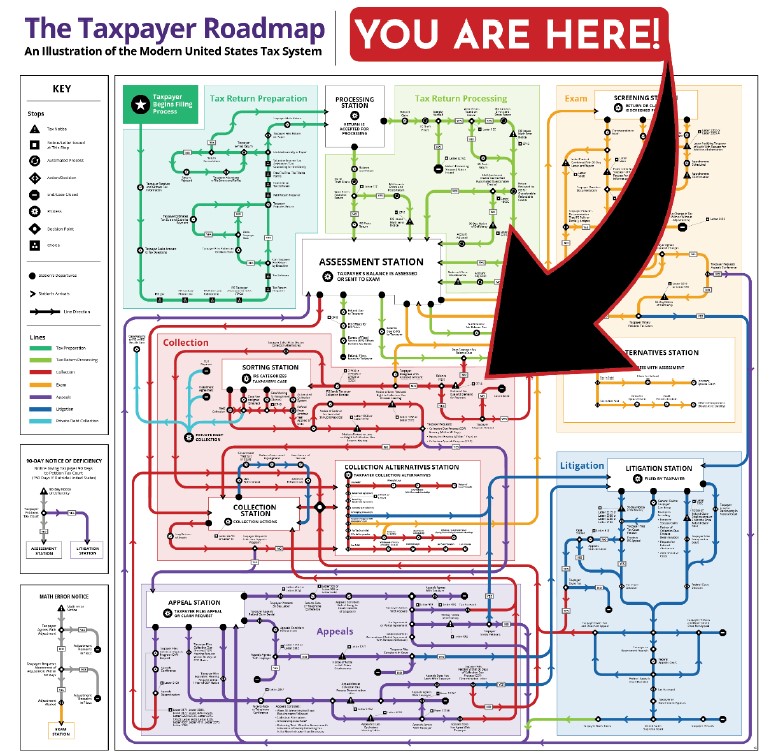

We know our tax system is complicated and that mistakes happen; let us help!

- IRS Letters, Liens, and Levies: if you get that nasty-gram from the tax authorities, let us help you understand it and take timely action to avoid the problem

- Non-filer: If you have a backlog of years of unfiled returns, we can help you come into compliance!

- If the IRS has estimated your tax bill by creating a substitute for return itself you should file your own as they won’t have all the details and aren’t looking to minimize your taxes.

- Voluntarily coming into compliance has advantages like avoiding certain penalties and fines and being eligible for other solutions.

A core strength of our firm is our bookkeeping clean-up practice: we can get you from boxes of receipts to tax filing with speed and efficiency.

- Large tax bills: If for whatever reason, such as an adverse audit outcome or you have simply failed to pay, the IRS has sent you a bill you cannot immediately pay, we can help you find a solution!

- An installment agreement lets you pay over time, but there are hurdles to having a plan approved

- An offer in compromise may allow you to pay less than the full bill owed, but the criteria are stringent and demanding.

Our Enrolled Agent (the highest credential the IRS awards) has the knowledge and credentials to represent you to the IRS and our bookkeeping team can get your records in order fast.

Contact us to get your tax problems solved!