“So how do I know how much money I *really* made last month?”

As you read earlier, the Balance Sheet shows you what your business’s finances look like for a single day. But what about how much your business earned in a particular period of time?

Enter the Income Statement.

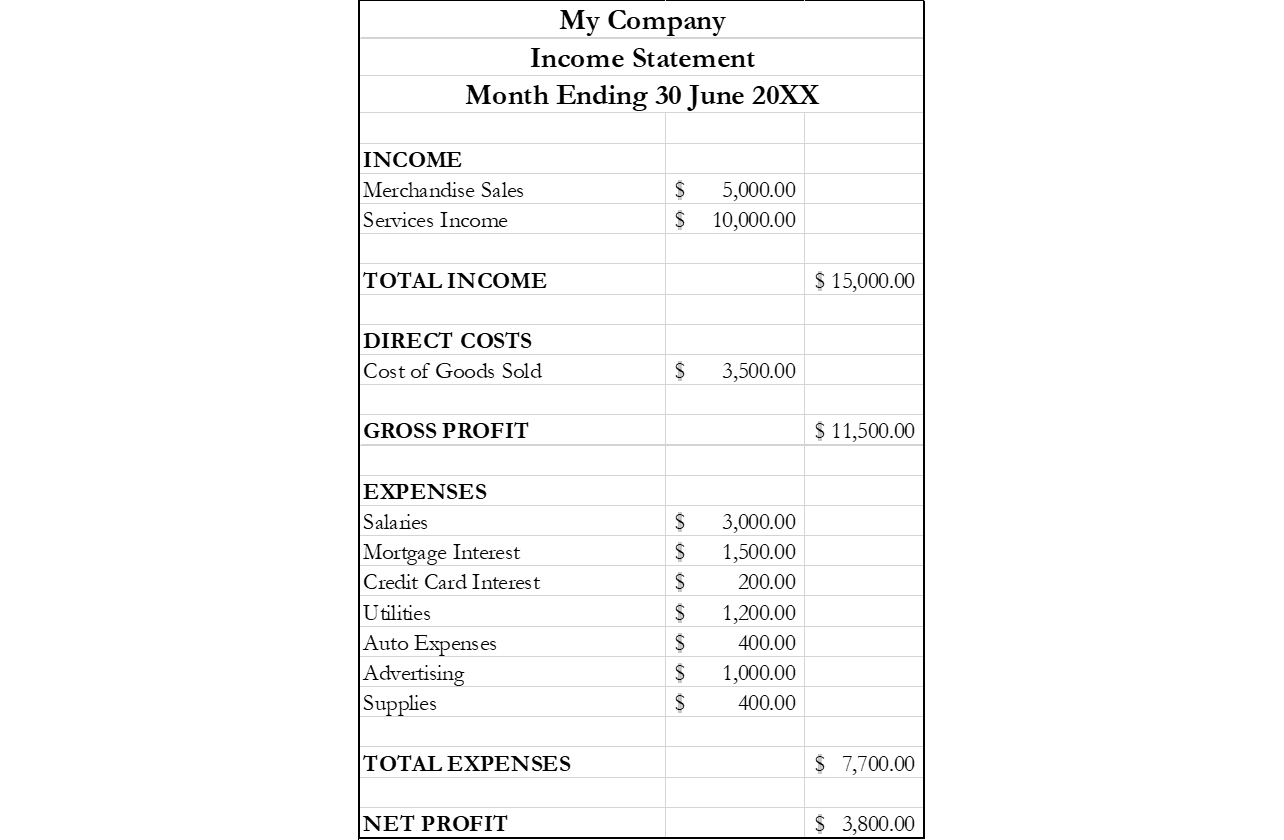

The Income Statement (or Profit & Loss Statement, or P&L) provides an outline of what your business earned (Income), along with what your business spent (Costs and Expenses).

INCOME is comprised of Operating Income (i.e., sales income) and sometimes Gains. The second section is the DIRECT COSTS, which are costs that are a direct result of providing the sales and services. INCOME minus DIRECT COSTS gives you the business GROSS PROFIT.

Next you have the EXPENSES section. This section is sometimes called Indirect Costs since these expenses are a result of normal business operations whether or not a sale is made.

After subtracting the EXPENSES, you get the final result of the Income Statement: NET PROFIT. Technically, that figure can be positive or negative (at which point the proper term would be NET LOSS).

Unlike the Balance Sheet, the Income Statement shows activity over a period of time. The two most common date ranges for Income Statements are one month and one year, but your accounting software can create an income statement for any period of time.

So now you can look at a snapshot of your business’s finances with the Balance Sheet, as well as how your business performed with the Income Statement.

But what about which way the money is moving? Stay tuned for the next segment which talks about the Statement of Cash Flows.

Any questions? Need help with reading your own Income Statement? Send me an email and we’ll work through it!