My revenues are lower now due to measures to prevent the spread of COVID-19. Is there any kind of financial assistance to help my business stay afloat?

My revenues are lower now due to measures to prevent the spread of COVID-19. Is there any kind of financial assistance to help my business stay afloat?

All fifty states have been declared disaster areas in light of the COVID-19 pandemic. This declaration allows the United States Small Business Administration (SBA) to offer funding through its Economic Injury Disaster Loan program (EIDL) to small businesses, small agricultural cooperatives, and most private nonprofit organizations if those entities have suffered substantial economic injury. Substantial economic injury is defined as the inability of a business to meet its obligations or pay ordinary and necessary operating expenses due to the disaster; the SBA loan is meant to provide working capital to allow the business to survive until normal times return.

Unlike other SBA programs, the EIDL funds are lent directly by the SBA rather than through a funding partner like a local bank; in theory, this should speed the application process and disbursements. The maximum loan amount is US$2 million with the amount determined on a case-by-case basis according to the economic injury your business has suffered and your ability to repay.

Key things to know about the EIDL:

- These are loans, not grants. You’ll have to pay it back!

- Your business is only eligible if there is no access to other credit.

- The loans have a maximum maturity of 30-years, though the actual maturity and repayment plan will be determined on a case-base basis according to ability to repay.

- The borrower must have a credit history acceptable to the SBA.

- The SBA requires collateral for the EIDL program for loans over $25,000 and will take real estate when it can. It may seek collateral from a business’s principals.

- The maximum annual interest rate for small businesses is 3.75% and 2.75% for nonprofits.

- You may be required to take out credit insurance for the SBA.

The US Congress is considering further economic support, but the form at the time of this writing is uncertain. It may make sense to apply for an EIDL from the SBA now as applications will take time. You can always decide to decline it if better options become available.

Here’s a couple of links for learning more:

SBA to Provide Disaster Assistance Loans for Small Businesses Impacted by Coronavirus (COVID-19)

Coronavirus (COVID-19): Small Business Guidance & Loan Resources

As a last thought, in tough times, cash is king. Maintaining liquidity is always a sound strategy. If you have excess cash available to you or can find funding at decent terms (like the EIDL) and must meet obligations (i.e., payments to suppliers and landlords) it may make sense to negotiate for discounts or better future terms in exchange for immediate payment. If you don’t ask, you don’t get.

Are you overwhelmed with getting your finances together for these applications? Send us a message to find out if Sunstone Bookkeeping can help you get started!

“I need to buy a gift for my kid’s birthday. Is it okay to write a check from my company’s bank account to pay the toy shop?”

“I need to buy a gift for my kid’s birthday. Is it okay to write a check from my company’s bank account to pay the toy shop?”

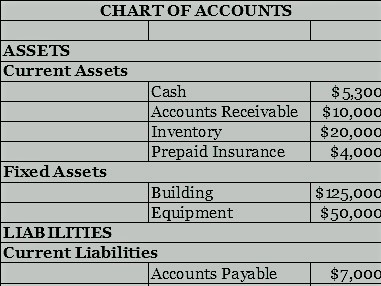

“Okay, I’ve got that box of receipts, vendor bills, loan docs, paid invoices … so what goes where?”

“Okay, I’ve got that box of receipts, vendor bills, loan docs, paid invoices … so what goes where?”

I am inundated with all of these papers – receipts, statements, notes, forms, invoices, bills. ARGH! Do I really need keep all of them?!

I am inundated with all of these papers – receipts, statements, notes, forms, invoices, bills. ARGH! Do I really need keep all of them?!