So, you filed your taxes – congrats!

Are you expecting a refund? Or do you need to verify your tax return was filed?

Are you the sort of person who eagerly tracks expected deliveries from the likes of Amazon and eBay?

Then, we have good news for you!

Did you know you can track your filing and refund status with Dude, Where’s my Refund? on the Internal Revenue Service website?

(Note: The “Dude” part is our attempt at cultural humor and not part of the official site name … yeesh, such a missed opportunity.)

This tool will provide you with a personalized date only after the return is processed and a refund is approved – usually within 21 days.

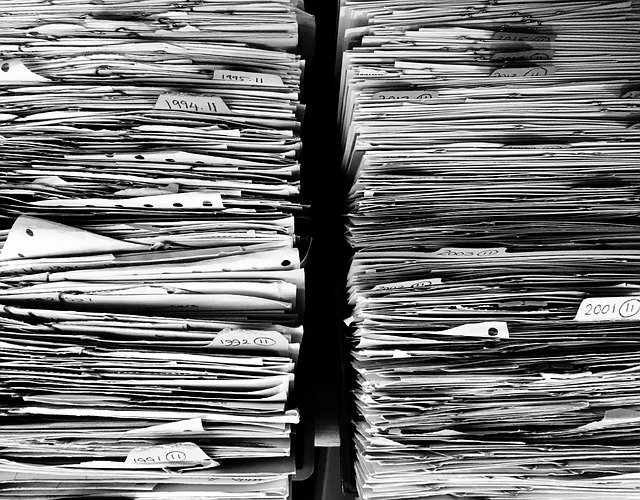

It is worth noting that the IRS is jammed because of last year’s extensions and the numerous legislative actions that have altered tax policy, so tax documents that were mailed in are taking longer to process. If you are in a hurry for that refund and have yet to file, it may be advisable to file electronically.

The IRS site warns that delays could also result from errors in the return, identity theft, or fraud, so keeping an eye on the refund tracking tool may give an early alert that there are issues with your return.

This brings us to an unappreciated fact about the IRS: the agency is actually a great source of information. Their website is reasonably easy to search, and the publications are well-organized and straightforward.

It is tempting to chalk it up to the agency wanting to give you zero reasons not to pay your taxes. But we prefer to view it as the agency’s way of making an irritating yet mandatory process as manageable as possible – including tracking your refund.

If you operate your business from your home, chances are high that you’ve been considering how to deduct the use of your home space on your taxes. The good news: The Internal Revenue Service offers home office deductions for business owners who don’t own or rent space for business operations. The bad news: Those deductions are subject to specific definitions of what qualifies as a “home office”.

If you operate your business from your home, chances are high that you’ve been considering how to deduct the use of your home space on your taxes. The good news: The Internal Revenue Service offers home office deductions for business owners who don’t own or rent space for business operations. The bad news: Those deductions are subject to specific definitions of what qualifies as a “home office”.

“OK, you’ve

“OK, you’ve