“OK, you’ve already said that all these business receipts/canceled checks/bills/invoices/register tapes are important to hold on to. Really, are they THAT important?”

“OK, you’ve already said that all these business receipts/canceled checks/bills/invoices/register tapes are important to hold on to. Really, are they THAT important?”

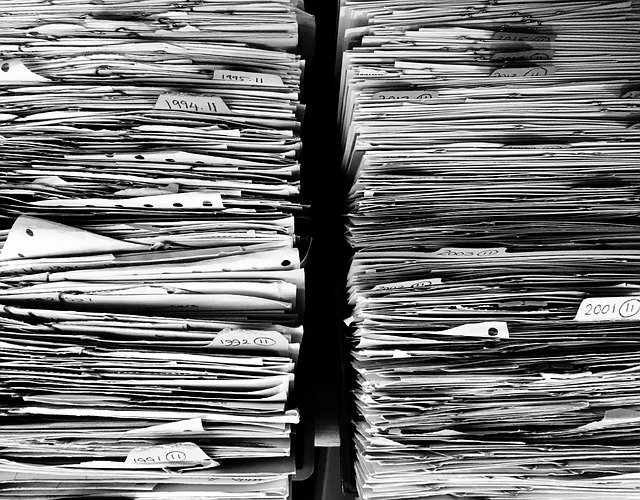

Yes. They are THAT important. And I mean totally, completely, and unequivocally IMPORTANT.

(Yes, bold caps was necessary.)

There are many reasons why they are IMPORTANT (yes, that needed to be in bold caps again), but I’ll start with the more timely since I’m writing this in February: TAXES.

You should always prepare your tax filing as if an auditor from the Internal Revenue Service is going to appear at your door the second the paperwork is processed, ready to demand proof of your calculations. (In fact, your tax preparer has a duty to calculate your taxes as if this exact scenario were to happen.)

In other words, if you can’t defend the expenses you claimed, you could be in for a lot of frustration, headaches, and probably some fines and penalties.

Therefore … fewer receipts on hand at tax time means less proof of deductible expenses, which means fewer expenses you can deduct, which could mean more taxes that you owe.

The IRS Publication 583 “Starting a Business and Keeping Records” may not have the most riveting plotline, but it’s a great reference for all things related to supporting documents.

Make your tax filing season less stressful … and save those receipts!